It pays to be obvious, especially if you have a reputation for subtlety.

–Isaac Asimov

Earlier this month, the U.S. Court of Appeals for the Tenth Circuit held that Texas law allows an indemnity agreement to insulate a party from the consequences of its own, allegedly negligent conduct, but only if that feature of the agreement is disclosed conspicuously. In Martin K. Eby Construction Co., Inc. v. Kellogg Brown & Root, Inc., No. 13-3027 (10th Cir. Dec. 9, 2014), the disclosure was insufficiently ostentatious, and the agreement was unenforceable. In that case, the would-be indemnitor also had an insurance policy, which covered additional parties whose liabilities the named insured had “assumed” in a “covered contract.” But because the underlying indemnity agreement had been too unassuming, the Court held that no liability had been “assumed,” and coverage was unavailable.

We’ve Got You Covered

The case was brought by construction subcontractor Kellogg, Brown & Root (“KBR”), against its principal, Martin K. Eby Construction Company (“Eby”), and Eby’s insurer. Eby was retained to build a water pipeline, and it subcontracted some of the work to KBR. While building the pipeline, Eby accidentally hit a methanol pipeline, causing a leak that was not discovered until later. When the owner of the methanol pipeline finally discovered the leak, it sued both Eby and KBR—in KBR’s case, for its allegedly wrongful failure to correct and/or disclose the damage. Ultimately, Eby and KBR prevailed in the suit, but it cost KBR over $2,000,000 in fees and costs.

Luckily for KBR, its contract with Eby contained a broad indemnity agreement: Eby promised to indemnify KBR for all claims, including attorneys’ fees and expenses, “directly or indirectly arising from or caused by or in connection with the performance for failure to perform any work” by Eby. The Tenth Circuit expressly found that this language was broad enough to cover a claim against KBR for failing to correct a condition that Eby had created. Luckier still, Eby was covered under a liability policy issued by Travelers, and that policy insured additional parties whose liabilities were “assumed” by Eby in a “covered contract.”

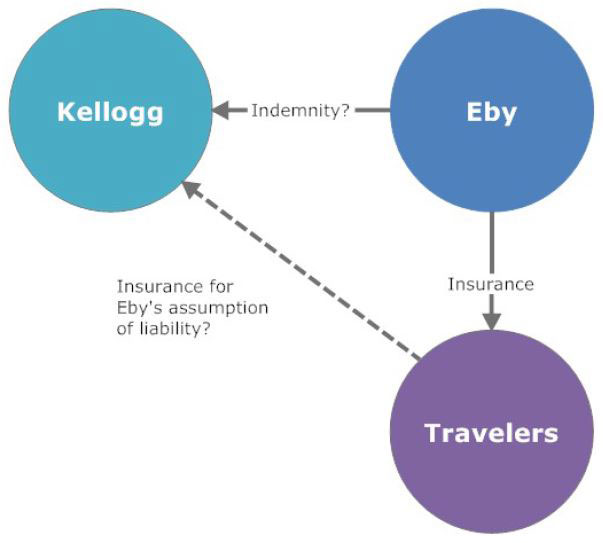

KBR, therefore, brought an action against both Eby and its insurer, to recover the fees and costs it had incurred in the underlying suit. After the trial court granted summary judgment to the defendants, the Tenth Circuit—in what might have been a subtle hommage to the holiday season, or, perhaps, an effort to connect with the junior-high-school-science-teacher demographic, laid out the coverage issues in the form of a colorful bubble diagram:

Can You Hear Me Now?

Unluckily for KBR, the district court held that Eby’s indemnity agreement was unenforceable, because it was not sufficiently CONSPICUOUS to pass muster under Texas’s law. KBR appealed.

The Tenth Circuit explained that Texas law limits enforcement of indemnity agreements, under what has been deemed the “fair notice” rule, which was first enunciated in Dresser Indus., Inc. v. Page Petroleum, Inc., 853 SW. 2d 505, 508 (Tex. 1993). Under the rule, any promise to indemnify a party for its own negligence must be BOTH (1) “expressly stated” AND (2) “CONSPICUOUS.” A clause is considered CONSPICUOUS if it would attract the attention of a reasonable person. Id.

Examples from cases indicate that there are a number of ways to attract attention to a clause, such as different sized type, ALL CAPITAL LETTERS in a heading, and different colors. The Tenth Circuit Court held that the method chosen by KBR—placing the clause in ordinary type on page 86 of a 197-page document, in a section of the agreement with the heading “Protection of Existing Structures and Facilities”—did not pass muster.

Moreover, after analyzing numerous Texas cases, the Court further held that the “fair notice” rule ALSO applies to agreements that purport to indemnity a party for its own intentional wrongdoing and for strict liability-type claims—such as the violations of federal and state environmental laws that had been asserted against KBR in the underlying case. The fact that the underlying case also asserted independent wrongful acts by Eby did not change this result; the fair notice rule applied, and the entire indemnification clause was thus unenforceable, regardless of whether it was also intended to indemnify KBR for Eby’s negligence.

No Tacit Assumption

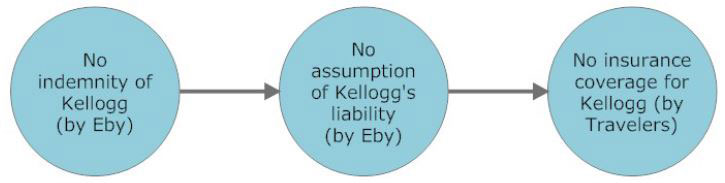

But what about Eby’s insurer, Travelers, which KBR also named in the suit? Given its holding that Eby owed no indemnity obligation to KBR, the Court had a simple, explanatory, full color, and CONSPICUOUS diagram to explain why Travelers was off the hook:

As the Court concluded, if it ain’t CONSPICUOUS, “it was as if the indemnity promise had never been made.”

Image source: Mateusz Drogowski (Flickr)