A homeowners insurance policy often covers every member of a family, and many policies state that the insurance applies separately to each insured. The same policies usually exclude coverage for intentional acts. But what happens when one insured is accused of negligently permitting a different, separately-covered family member to cause harm intentionally? Last month, in American National Property & Casualty Company v. Clendenen, No. 16-0290 (W. Va. Nov. 17, 2016), West Virginia’s Supreme Court of Appeals adopted a majority rule, which states that an intentional act exclusion applies to claims against an “innocent insured,” and that a severability clause does not supersede the operation of the exclusion.

They Really Did Go On Three

Clendenen involved the gruesome story of a high school friendship gone wrong. Skylar Neese was an outgoing, 16-year-old high school junior with an active social life. Shelia Eddy had been one of her best friends since grade school, and the two of them bonded with Rachel Shoaf after Rachel transferred to their school during freshman year. Eventually, for reasons that could only be deciphered in the glyphs of teenage Tweets, Shelia and Rachel decided they didn’t like Skylar any more. Unwilling to take the risk that an “unfriended” Skylar might reveal some of their secrets, the two girls decided to kill her.

On a July evening in 2012, the plotters persuaded Skylar to sneak out her bedroom window after midnight and jump into a car with them. They drove from their hometown of Morgantown, West Virginia, to a remote area in the woods across the Pennsylvania line. Once out in the woods, Shelia and Rachel pretended to have left something in the car, and Skylar agreed to go get it. When her back was turned, the other girls counted to three, then stabbed Skylar to death. A month after their friend had been reported missing and become the subject of a neighborhood search (in which the two killers participated), Shelia tweeted, “we really did go on three.”

Trial by Twitter

Police unraveled the case through social media, even going so far as to construct a fake Twitter account for an invented student at Shelia and Rachel’s school. They suspected the two from the get-go, and the pressure ultimately got to Rachel, who had a mental breakdown and, after a stay in a psychiatric care unit, confessed to the crime and led authorities to the body. Both Shelia and Rachel were charged with Skylar’s murder and tried as adults. Shelia pled guilty and was sentenced to life in prison. Rachel was sentenced to thirty years.

The Insurance Claim

Ultimately, Skylar’s Estate sued Shelia and Rachel for wrongful death. The Estate also sued Shelia’s mother, Tara Clendenen, and Rachel’s mother, Patricia Shoaf, asserting theories of negligent supervision and entrustment —in part, for allowing Shelia and Rachel to use Tara Clendenen’s car in their murder plot. Ms. Clendenen and Ms. Shoaf sought defense and indemnification for the suit under their respective homeowners and auto policies. Each of those policies contained exclusions for liability arising from intentional acts, and both of the homeowners policies contained severability clauses, which stated that coverage would apply separately to each insured. The homeowners policies also excluded claims for bodily injury that was “intended by any insured,” and Ms. Clendenen’s policy further excluded such claims when they arose out of the “entrustment” of a motor vehicle.

The relevant provisions read, in pertinent part, as follows:

The Clendenen auto policy:

There is no coverage under PART I — LIABILITY: . . . (11) for bodily injury or property damage which exceeds the mandatory limits of financial responsibility of West Virginia, when caused intentionally by or at the direction of any insured person.(12) for punitive or exemplary damages; . . . (16) for bodily injury or property damage which occurs while participating in or preparing to commit a criminal act.

The Shoaf auto policy:

“We” do not cover: . . . damages caused intentionally by or at the direction of “anyone we protect.”

The Clendenen homeowners policy

Severability of Insurance. This insurance applies separately to each insured. This condition shall not increase our limit of liability for any one occurrence.

Coverage E–Personal Liability and Coverage F–Medical Payments to Others do not apply to bodily injury or property damage:

- Which is expected or intended by any insured even if the actual injury or damage is different than expected or intended;

***

- Arising out of the ownership, maintenance, use, loading, or unloading of motor vehicles or all other motorized land conveyances, including any attached trailers, owned or operated by or rented or loaned to any insured.

***

- Arising out of the entrustment by any insured to any person any of the following:

(1) an aircraft;

(2) a watercraft; or

(3) a motor vehicle or any other motorized land conveyance;

***

- Arising out of any criminal act committed by or at the direction of any insured;

The Shoaf homeowners policy

We do not cover under Bodily Injury Liability Coverage, Property Damage Liability Coverage, Personal Injury Liability Coverage and Medical Payments To Others Coverage: 1. Bodily injury, property damage or personal injury expected or intended by anyone we protect

* * *

This insurance applies separately to anyone we protect.

(emphases added)

The Insurers’ Declaratory Judgment Action

Based on the above policy provisions, the mothers’ insurers brought a declaratory judgment action in the U.S. District Court for the Northern District of West Virginia, seeking a declaration that neither insurer had a duty to defend or indemnify any of the insureds – either daughters or parents – under any of the relevant home or auto policies.

After summary judgment briefing, the federal court found that Skylar’s murder was an “occurrence” within the meaning of the policies, at least insofar as it involved alleged negligence on the part of the parents. However, the court also held that the intentional act exclusions unambiguously barred the claims from coverage. This ruling effectively disposed of the claims under the auto policies. However, the insureds argued that the claims against the parents were still covered under the homeowners policies, because both those policies provided that coverage applied “separately” to the insured mothers, and because the claim against the mothers did not charge them with having acted intentionally.

The federal court was unable to divine West Virginia public policy on the question of whether a severability clause supersedes the operation of an intentional acts exclusion, and, therefore, it certified the question to the Supreme Court of Appeals of West Virginia.

Severability

The Supreme Court first addressed the question of whether the intentional or criminal acts exclusion applied. Following the majority of other jurisdictions, it hold that the exclusions applied unambiguously, because they barred claims arising from intentional or criminal acts committed by”any” insured.

The question, then, was whether the severability clauses meant that claims against each insured should be viewed without reference to claims against other family members. On that issue, a minority of courts have held that the requirement to apply coverage “separately” is in “conflict” with an exclusion based on the actions of “any” insured—and that this “conflict” establishes an ambiguity that must be resolved in favor of the policyholder. E.g., Minkler v. Safeco Ins. Co. of Am., 232 P.3d 612 (Cal. 2010).

The majority of jurisdictions reject that position; they find that it unreasonably treats the severability clause as

require[ing] that each insured’s conduct be analyzed as if he or she were the only insured under the policy.”

American Family Mutual Insurance Company v. Wheeler, 287 Neb. 250 (2014). The West Virginia court sided with the majority, citing American Family Mut. Ins. Co. v. White, 65 P.3d 449, 456 (Ariz. Ct App. 2003):

“Most courts that have construed the phrase ‘any insured’ in an exclusion have found that it bars coverage for any claim attributable to the excludable acts of any insured, even if the policy contains a severability clause.”

Thus, for any claim involving liability asserted against multiple insureds, insurers and policyholders alike must ascertain whether the applicable jurisdiction represents the majority or minority view on the interplay between intentional act exclusions that apply to “any” insured, and severability clauses that deem the insurance to apply to each insured separately.

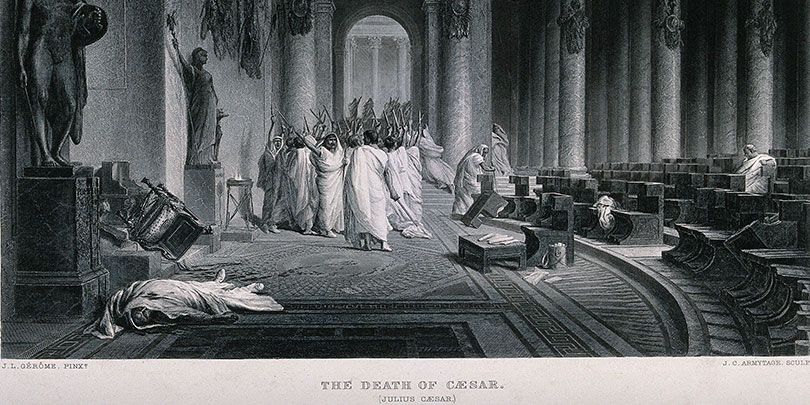

Image source: See page for author, via Wikimedia Commons