In Film Allman, LLC v. New York Marine and General Insurance Company, Inc., 2:14-cv-7069-ODW, (C.D. Cal. May 23, 2017), a California district court granted summary judgment in favor of an insurer of a production company. The court found no breach and no extra-contractual damages were warranted because the insurer paid full policy limits to settle the claims.

In Film Allman, LLC v. New York Marine and General Insurance Company, Inc., 2:14-cv-7069-ODW, (C.D. Cal. May 23, 2017), a California district court granted summary judgment in favor of an insurer of a production company. The court found no breach and no extra-contractual damages were warranted because the insurer paid full policy limits to settle the claims.

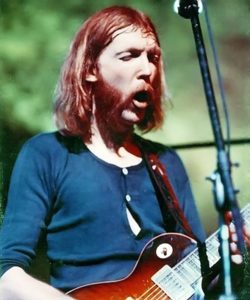

The insurance coverage dispute arose after production company Film Allman, LLC was sued as a result of a train accident that occurred on the set of a Greg Allman biopic. The accident resulted in the death of a camera operator and serious injuries to several other crew members.

The parents of the camera operator, as well as the other injured parties, sued Film Allman in separate actions. New York Marine was Film Allman’s insurer against claims arising from the making of the film. Film Allman was insured by New York Marine under three separate insurance policies: 1) a commercial general liability policy with a $1 million limit; 2) a commercial liability umbrella policy with a $4 million limit; and 3) a workers compensation and employers liability policy.

In late 2014, the parties in the underlying actions engaged in mediation. Because the potential liability of the action involving the death of the camera operator (the “Jones Action”) was highest, the mediation efforts focused on settling that action. The Jones Action eventually settled at mediation for a total of $6.5 million. Of this amount, New York Marine paid its limits of $5 million ($1 million for the commercial general liability policy and $4 million for the umbrella policy). The company that owned the land on which the accident occurred contributed the remaining $1.5 million.

Having exhausted the limits of both policies, New York Marine advised Film Allman that its duty to defend in connection with the accident had terminated. Film Allman demanded New York Marine continue to defend the remaining actions, and when New York Marine refused, Film Allman filed suit.

The district court granted summary judgment to New York Marine on Film Allman’s breach of contract and breach of implied covenant of good faith and fair dealing causes of action. The court found that because the policy in question expressly provided that the duty to defend terminated upon exhaustion of policy limits, the duty to defend an insured was extinguished once a carrier expended the limits of its policy in defending an action.

In its opposition, Film Allman argued that New York Marine could have successfully defended the actions and that it should have been entitled to independent counsel. However, the court rejected these arguments and stated that New York Marine had the right and motivation to settle the litigation within its policy limits. In addition, the court found that because New York Marine defended Film Allman without a reservation of rights, it had the right to control the defense. In its analysis, the court first noted the California rule that if an insurer does not settle a case within policy limits and ends up exposing the insured to an excess judgment at trial, the insurer may be liable for bad faith. Murphy v. Allstate Ins. Co., 17 Cal. 3d 837, 941 (1976). Had New York Marine chosen not to settle the lawsuit within its policy limits when it had the opportunity to do so, it would have potentially exposed itself to bad faith liability if the ultimate liability against the insured exceeded the policy limits.

Thus, although Film Allman was dissatisfied with the way New York Marine settled the action, New York Marine had the right to settle it and thus no triable issue of fact existed. The court stated:

“Film Allman takes the position now, in hindsight, that the Exclusive Remedy doctrine would have been a foolproof defense. In reality, New York Marine had the right to protect against the possibility that the Jones action plaintiffs would prevail and expose it to much larger liability. In sum, while Film Allman would have liked for its insurer to extend coverage beyond what Film Allman actually paid for rather than use up the policy limits dispensing with one case, there is no support for this.” (citations omitted)

The court also rejected Film Allman’s argument that coverage should have continued under the worker’s compensation policy. Since the injured employees filed worker’s compensation claims against the payroll company, which was the employer of record and not insured by New York Marine, no duty to defend existed under this policy.

As to the breach of implied covenant of good faith and fair dealing, the court also granted summary judgment, finding that because New York Marine was not obligated to continue defending Film Allman, it did not act unreasonably and therefore no breach occurred.