Under New York law, a liability insurer is required to deny coverage for bodily injury resulting from an auto accident “as soon as is reasonably possible.” N.Y. Ins. Law § 3420(d)(2). The Second Circuit recently shed light on what constitutes a reasonable time within the meaning of this statute in United Financial Casualty Co. v. Country-Wide Insurance Co., No. 18-3022 (2d Cir. July 1, 2019). In that case, Juan Pineda was involved in a three-vehicle accident while ... Keep Reading »

Colorado Federal Court Rejects Attorney-Client Privilege for Communications Between Insurer’s Claims Adjuster and In-House Counsel

In Olsen v. Owners Insurance Co., No. 1:18-cv-01665, 2019 WL 2502201 (D. Colo. June 17, 2019), the U.S. District Court for the District of Colorado found that neither the attorney-client privilege nor the work-product doctrine protected documents containing communications between the insurer's claims adjuster and its in-house counsel, where such documents did not contain legal advice or the insurer's strategy for defending against the civil action. In this case, the ... Keep Reading »

New York State Court Affirms All-Sums Allocation Method

A New York state court explored the proper allocation method for insurance policies with non-cumulation clauses covering asbestos exposure loss occurring over the course of multiple successive policy periods in In re Liquidation of Midland Insurance Co. At issue were four excess policies issued by Midland to ASARCO LLC, which, through one of its subsidiaries, engaged in the selling of asbestos products. A series of asbestos claims against ASACRO ensued, and ASARCO sought ... Keep Reading »

EDNY “Teas” It Up On Additional Insured, Finds Insurer May Withdraw Defense and Recoup Defense Costs

Given the broad duty to defend rules in most jurisdictions, liability insurers often find that they must — or perhaps should out of an abundance of caution — defend an insured against a claim that in all likelihood will not implicate the duty to indemnify, such as when extrinsic evidence strongly suggests that an exclusion will apply. In these situations, insurers in many states are permitted to offer a defense under a reservation of rights to withdraw and seek ... Keep Reading »

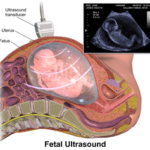

Missouri Appeals Court Rules That Insurer Must Pay Double Policy Limits in Medical Malpractice Claim Involving Birth Injuries

In John Patty, D.O., LLC v. Missouri Professionals Mutual Physicians Professional Indemnity Association, No. ED106747 (Mo. Ct. App. Apr. 23, 2019), a Missouri appellate court rejected the lower court’s decision regarding liability limits in a medical malpractice suit involving injuries to both mother and baby. Specifically, the court held that because allegations of a physician’s negligence included acts and omissions, which occurred not only before and during a cesarean ... Keep Reading »

Destination Arbitration: Court Holds Service-Of-Suit Clause Does Not Conflict With Policy’s Arbitration Requirement

Coverage disputes often come down to the interplay between endorsements and the body of the policy. But this tension is not limited to terms addressing coverage. It can also extend to areas such as dispute resolution. In Southwest LTC-Management Services, LLC v. Lexington Insurance Co., No. 1:18-cv-00491-MAC (E.D. Tex. Apr. 17, 2019), the court held that a service-of-suit endorsement did not supersede the arbitration clause in the policy. A group of carriers paid $2.5 ... Keep Reading »

Back to Basics: The Georgia Court of Appeals Distinguishes Acceptance From Counteroffer

The Georgia Court of Appeals recently reiterated the fundamentals of contract law within the context of insurance settlement negotiations in Yim v. Carr. In this case, the plaintiff offered to settle within policy limits and to release liability against specific persons or entities. The defendant's insurer agreed to the settlement in principle, but sought clarification about who would be included in the release. Ultimately, the court held that this did not constitute ... Keep Reading »

Tennessee Supreme Court Holds That Replacement Cost Less Depreciation Does Not Allow for Depreciation of Labor When Calculating Actual Cash Value of a Property Loss

Insurance policies are designed to indemnify an insured by putting the policyholder in the same position he or she would have been in had no loss occurred. In the context of property insurance policies, damaged property is typically valued based on its estimated actual cash value (ACV) if it is not repaired or replaced. In order to calculate ACV, an insurer will often calculate the replacement cost (RCV) based on the cost to repair or replace the property with materials ... Keep Reading »

Florida Legislature Passes Sweeping Assignment of Benefits Legislation

Significant changes appear to be in the pipeline for Florida property insurers after the Florida legislature passed sweeping assignment of benefits (AOB) reform legislation last week. If the legislation is signed into law (Governor DeSantis has indicated it will be), it will take effect on July 1, 2019. The legislation applies to residential and commercial property insurance policies and includes new restrictions on AOBs, changes to the fee-shifting framework for AOB ... Keep Reading »

California Federal Court Holds Scope of Duty to Defend Is Determined by the Language of the Contract

In Harper Construction Co. v. National Union Fire Insurance Co. of Pittsburgh, No. 3:18-CV-00471-BAS-NLS (S.D. Cal. Mar. 28, 2019), the Southern District of California rejected an insured's attempt to expand a CGL policy's definition of "suit" to encompass mere demands without a formal proceeding for damages. In 2007, the federal government awarded a contract for a military training facility in Fort Sill, Oklahoma, to an insured general contractor. After structural ... Keep Reading »

- « Previous Page

- 1

- …

- 20

- 21

- 22

- 23

- 24

- …

- 48

- Next Page »