The Eleventh Circuit, in the matter of QBE Specialty Insurance Co. v. Scrap Inc., affirmed the district court’s decision to grant summary judgment in favor of QBE holding that there was no indemnity coverage for an underlying judgment where a non-allocated verdict form was used because the insured could not meet its burden of allocating between coverage and uncovered damages. Background QBE Specialty Insurance Co. issued a general commercial liability (GCL) ... Keep Reading »

Declaratory Judgment

Pennsylvania Court Ices General Reservation of Rights Letters: Insurers Must Specify “Emergent Coverage Issues”

In Selective Way Insurance Co. v. MAK Services Inc., the Superior Court of Pennsylvania reversed an insurer-favorable summary judgment after finding that its reservation of rights letter was insufficient. Following what appeared to be a standard slip-and-fall case, an insurer provided a defense under a reservation of rights to its insured — a snow and ice removal company. Astonishingly, the policy contained a snow and ice removal exclusion, barring coverage for bodily ... Keep Reading »

Are COVID-19 Business Interruption Claims Appropriate for a Coverage Class Action?

Over the last few weeks, a tsunami of lawsuits has been filed in many states alleging a variety of issues related to the global COVID-19 pandemic. The lawsuits have targeted a variety of industries, such as banking and financial services, travel and hospitality, and retail. The property and casualty insurance industry has also been in the news as likely hundreds of thousands of policyholders have faced shutdowns of their businesses. These policyholders have looked to ... Keep Reading »

Business Interrupted: Policyholders Seek to Avoid the “Direct Physical Loss or Damage” Requirement for Business Interruption Insurance in the Wake of the COVID-19 Pandemic

The COVID-19 pandemic has swept the world, altering every aspect of daily life — whether it be a morning trip to the gym, a day at the office, a dinner at the Italian restaurant across the street, or a Friday night concert in the park. Businesses, particularly those in the service sector, have halted or restricted their operations, either voluntarily or by government order, in an effort to curb the spread. In these uncertain times, many businesses want to seek coverage ... Keep Reading »

Seventh Circuit Finds “Based Upon or Arising Out of” Language in Contract Exclusion Renders Coverage “Illusory”

In Crum & Forster Specialty Insurance Co. v. DVO, Inc., No. 18-2571 (7th Cir. Sept. 23, 2019), the Seventh Circuit reversed a decision of the U.S. District Court for the Eastern District of Wisconsin, finding that the contractual liability exclusion in an E&O policy containing “based upon or arising out of” language rendered coverage under the policy “illusory” and therefore must be reformed to match the policyholder’s “reasonable expectations.” The appeal ... Keep Reading »

New York Supreme Court Holds Documents Created By Counsel During Claims Handling Were Not Privileged

Pharmavite LLC filed a statement of loss under a policy issued by Crum & Forster Specialty Insurance Co. Crum & Forster disclaimed coverage, and Pharmavite commenced an action for breach of contract and declaratory judgment. After the parties disputed whether certain documents in Crum & Forster's privilege log were discoverable, the court conducted an in camera review and ordered Crum & Forster to disclose all documents. Crum & Forster moved to ... Keep Reading »

New York’s Highest Court Holds Untimely Disclosure Is Not an Untimely Disclaimer

The defendant, Preferred Contractors Insurance Company Risk Retention Group LLC (PCIC), is a risk retention group charted in Montana and doing business in New York. PCIC issued a CGL policy naming defendant Nadkos Inc. as an additional insured for liability related to the ongoing operations of the subcontractor and other members of the risk retention group. PCIC disclaimed coverage for Nadkos for an underlying personal injury action by an employee of Nadkos' ... Keep Reading »

When Should an Insurer Deny Coverage? The Second Circuit Provides Guidance on What Constitutes a Reasonable Time by Which to Deny Coverage Under New York Law

Under New York law, a liability insurer is required to deny coverage for bodily injury resulting from an auto accident “as soon as is reasonably possible.” N.Y. Ins. Law § 3420(d)(2). The Second Circuit recently shed light on what constitutes a reasonable time within the meaning of this statute in United Financial Casualty Co. v. Country-Wide Insurance Co., No. 18-3022 (2d Cir. July 1, 2019). In that case, Juan Pineda was involved in a three-vehicle accident while ... Keep Reading »

EDNY “Teas” It Up On Additional Insured, Finds Insurer May Withdraw Defense and Recoup Defense Costs

Given the broad duty to defend rules in most jurisdictions, liability insurers often find that they must — or perhaps should out of an abundance of caution — defend an insured against a claim that in all likelihood will not implicate the duty to indemnify, such as when extrinsic evidence strongly suggests that an exclusion will apply. In these situations, insurers in many states are permitted to offer a defense under a reservation of rights to withdraw and seek ... Keep Reading »

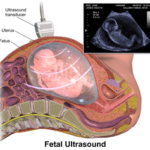

Missouri Appeals Court Rules That Insurer Must Pay Double Policy Limits in Medical Malpractice Claim Involving Birth Injuries

In John Patty, D.O., LLC v. Missouri Professionals Mutual Physicians Professional Indemnity Association, No. ED106747 (Mo. Ct. App. Apr. 23, 2019), a Missouri appellate court rejected the lower court’s decision regarding liability limits in a medical malpractice suit involving injuries to both mother and baby. Specifically, the court held that because allegations of a physician’s negligence included acts and omissions, which occurred not only before and during a cesarean ... Keep Reading »

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- 6

- …

- 10

- Next Page »