Cooperation is key. Or so says the 10th Circuit at least, in addressing an appeal from a district court's dismissal of an insured's action in which he failed to cooperate with his insurer's claim investigation. The 10th Circuit held that the insured, Kelly Bryant ("Bryant"), had not clearly demonstrated that the insurance company, Sagamore Insurance Company ("Sagamore"), breached its contract or otherwise acted unreasonably and in bad faith when it denied Bryant's claim ... Keep Reading »

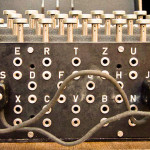

Cyber Risk as a Regulatory Issue: Tales of Encryption

Spurred by the prescient reporting found in this space (and, just maybe, by the Anthem data breach, which occurred a week later), insurance regulators have recently engaged in a flurry of regulatory activity relating to cyber security issues. Very shortly after the Anthem breach was announced, the newly-formed Cybersecurity (EX) Task Force of the National Association of Insurance Commissioners (NAIC) called for a multi-state examination of Anthem's cybersecurity ... Keep Reading »

California Bans Use of Price Optimization

Yesterday California Insurance Commissioner Dave Jones became the latest voice in a growing chorus of state insurance regulators who condemn the use of "Price Optimization" as a mechanism for adjusting property-casualty insurance rates and pricing. In a Notice delivered to more than 750 P&C insurers, the Commissioner declared that "any use of Price Optimization in the ratemaking/pricing process or in a rating plan is unfairly discriminatory in violation of ... Keep Reading »

New York Statute Aims to Curb Abuse of Certificates of Insurance

A certificate of insurance ("COI") is a document issued by an insurer or broker that evidences the existence of insurance coverage under specific circumstances. On January 28, 2015, New York’s Governor Andrew Cuomo signed into law a bill (S.6545-A/A.9590-A) that establishes standards for the issuance of COIs by insurers and insurance producers. The new law also authorizes the state’s Department of Financial Services ("DFS") to impose penalties for violations. The COI ... Keep Reading »

No Manifestation Destiny: The Seventh Circuit Declines to Set a Standard Trigger Rule for First-Party Property Policies

When I ... feel my finger on your trigger, I know no one can do me no harm." - John Lennon Property damage can be sudden and dramatic, but it can also be subtle and insidious, and that can make it hard to identify the moment when properly coverage is implicated. As a result, courts have recognized several different "triggers," depending on the circumstances of the loss and the type of coverage involved. In November 2014, in Strauss v. Chubb Indemnity Insurance ... Keep Reading »

Cyber Risk as a Regulatory Issue: A Connecticut Regulator Shares Her Insights

Even at Sony, cyber security was a hot topic before Kim Jong-un took an interest in Seth Rogen’s oeuvre. In 2011, hackers gained access to the personal and financial information Sony had collected on more than 100 million participants in its on-line gaming networks. The incident was the subject of more than 60 class actions, for which Sony announced a settlement last summer. Sony’s plight illustrates one facet of the interrelationship between cyber risk and ... Keep Reading »

“At-Issue” Waiver: It Ain’t Over Till It’s Over

When a claim goes south, the insured often pursues a bad faith claim. But even when the bad faith claim settles, that doesn't always mean the litigation is over. And that means it's still necessary to be vigilant about preserving the confidentiality of privileged communications. One way that insurers often waive the privilege inadvertently is by making statements during discovery that put the advice of counsel "at issue." Last month, in Seneca Insurance Co. v. Western ... Keep Reading »

Rumors of Revival Were Greatly Exaggerated: Fifth Circuit Reverses Opinion on Contractual Liability Exclusion

We previously discussed the opinion of the U.S. Court of Appeals for the Fifth Circuit in Crownover v. Mid-Continent Cas. Co., No. 11-10166 (5th Cir June 27, 2014)—an opinion that seemed to revive the contractual liability exclusion by distinguishing a landmark Texas decision that had narrowed the exclusion's scope. That was then. Late last year, the U.S. Court of Appeals for the Fifth Circuit withdrew that order and issued a new opinion on rehearing. The new opinion ... Keep Reading »

Connecticut Insurers Get a Day in Court to Resolve Regulatory Investigations

As Hillary Clinton can attest,some government investigations tend to drag on, and they create problems for their targets as long as they last. In late 2011, the targets of a lingering investigation by the Connecticut Insurance Department tried to lift the cloud over their business, by filing a declaratory judgment action in Superior Court. The trial court dismissed their suit, on the ground that the Department's proceedings had not yet run their course. But last ... Keep Reading »

A DJ is a Sometime Thing: In Declaratory Judgment Actions Over Coverage, the Sixth Circuit Gives Trial Courts a Wide Berth

The Declaratory Judgment Act, 28 U.S.C. § 2201, gives federal district courts "unique and substantial discretion" over whether to hear suits seeking a declaration of rights. Wilton v. Seven Falls Co., 515 U.S. 277, 286 (1995). To guide the exercise of that discretion, Courts of Appeals have created lists of relevant considerations—most of which were borrowed from Moore's Federal Practice. See Reifer v. Westport Ins. Co., 751 F.3d 129, 145 n.20 (3d Cir. 2014) ... Keep Reading »

- « Previous Page

- 1

- …

- 38

- 39

- 40

- 41

- 42

- …

- 48

- Next Page »